TRASPOL REPORT 1/22: Italian Long-Distance Coach Transport Market Report | Year 2021

Milano, 20.04.2022. It is now available online the latest issue of the “Italian Long-Distance Coach Transport Market Report”. Published by TRASPOL in collaboration with the search-engine Checkmybus.it, the new annual report provides an overview of the last five years, investigating the evolution of the market from 2017 to 2021. After the edition of 2020 with the first data on the consequences of the COVID-19 outbreak, this new edition shows us how the long distance coach market has reacted, finding a new “pandemic” equilibrium.

The report is based on the sample of prices collected by the sales platform and describes the profile of bus users, the prices charged, the main domestic routes and the most requested locations, with a specific focus on inter-regional airport connections.

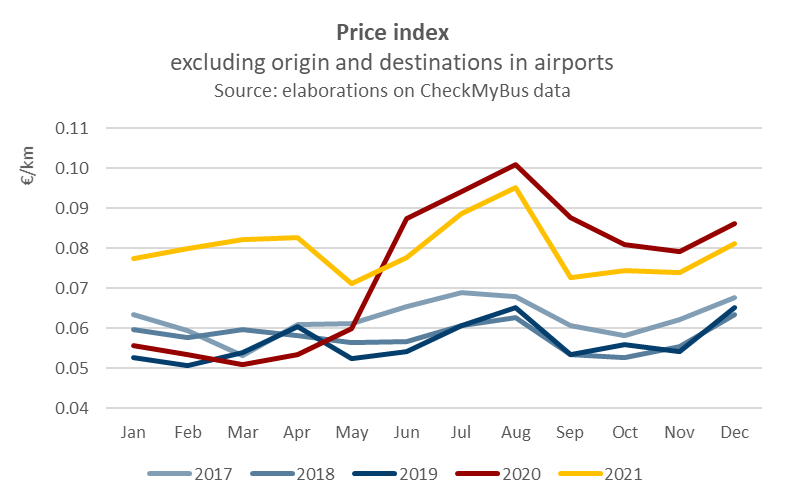

- The price index of 2021 2021 follows that of the second half of 2020, but on a lower level. The price difference of 2nd semester 2021 is 40% with respect to 2019, lower than the +55% of 2020. The first semester, instead, is not comparable with 2020, when prices were low, but the demand almost totally absent. Price increase of the first part of the year with respect to 2019 is +40%, similar to the rest of the year. It is worth remembering that prices increased significantly, but less than the reduction of capacity imposed by social distancing. This means that companies are under severe stress despite the reduction of production.

- The share of female travellers has nearly returned to pre-pandemic levels (53%), after the anomaly of 2020. To the contrary, the relative growth the group 18-24 years makes it again the most represented after the decrease of 2018 and 2019 in favour of elder classes. It is confirmed the impact of smart working, remote meetings and a reduced travel popension of over 35.

- In 2021, for the first time, the leading sub-market is the North – North relation, whose share increased of 8 points and the number of tickets searched of 91%. Longer relations like North – South show a continued decrease in relative (market share -5% with respect to 2020 and 8% with respect to 2019) and absolute terms (tickets searched: -25% with respect to 2020 and -75% with respect to 2019).

- For the first time, there are 4 relations internal to the North in the Top 10 interregional connections. The most searched routes are Lazio-Calabria (6%) and Lazio- Abruzzo (6%) followed by Lazio-Campania and Puglia-Campania at 5% each.

- Regarding main destinations in 2021, the top two (Rome and Naples) maintain their top spot while Torino takes the third spot of Milan and Malpensa jumps 3 spots overtaking Bologna and Firenze. Considering international routes, Rome maintaining its leadership.

- The 2021 and the 2020 curve follows the usual decreasing trend with distance for both the interregional routes and the airport routes and they converge for distances >400km. Major growth vs. 2019 is observed for shorter distances than 200 km.

- Before pandemic, largest companies were pricing below the national average thanks to their likely higher overall efficiency. During the 2nd semester of 2020 this trend has reversed and larger companies showed more capacity to extract revenues from passengers. In May 2021, we progressively returned to the pre-pandemic situation, with the Top-5 companies have a lower than average unit price (5-10%).

TRASPOL REPORT 1/22: Italian Long-Distance Coach Transport Market Report | Year 2021